Danielle wants to begin teaching personal finance to her 12-year-old daughter. What are some topics and resources she can use?

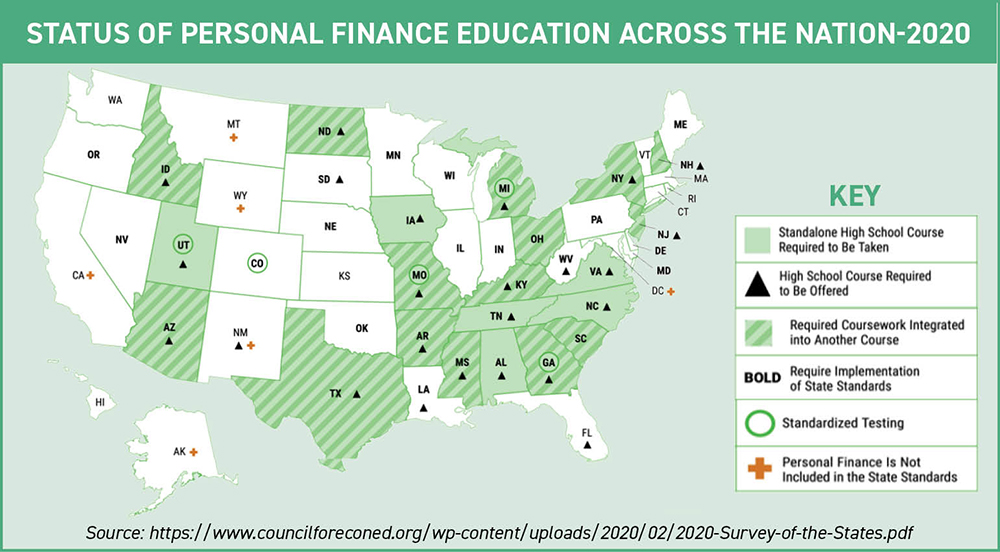

Sadly, personal finance is not taught in all schools, leaving parents the job to educate their children. Starting the money conversation at home will help Danielle’s daughter become financially literate. Developing financial skills will help her daughter when the time comes to manage her own finances.

Danielle can begin by talking about financial decisions and explain her own spending habits and how she manages the family budget.

They can implement a hands-on joint project to help her daughter get first-hand experience. For example, Danielle can let her daughter help with grocery budgeting.

And Danielle can help her daughter save her allowance, earnings, or money gifts in a savings account that she can then use for a special purchase.

Client Profile is based on a hypothetical situation. The solutions discussed may or may not be appropriate for you.