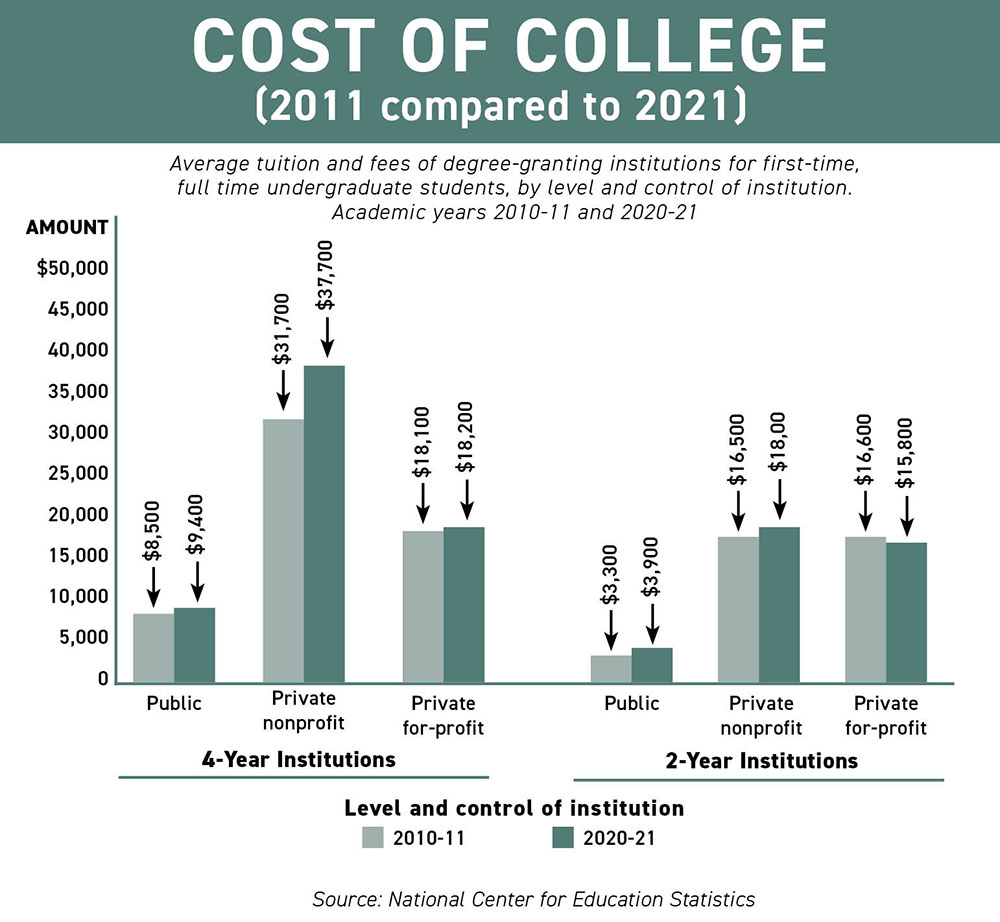

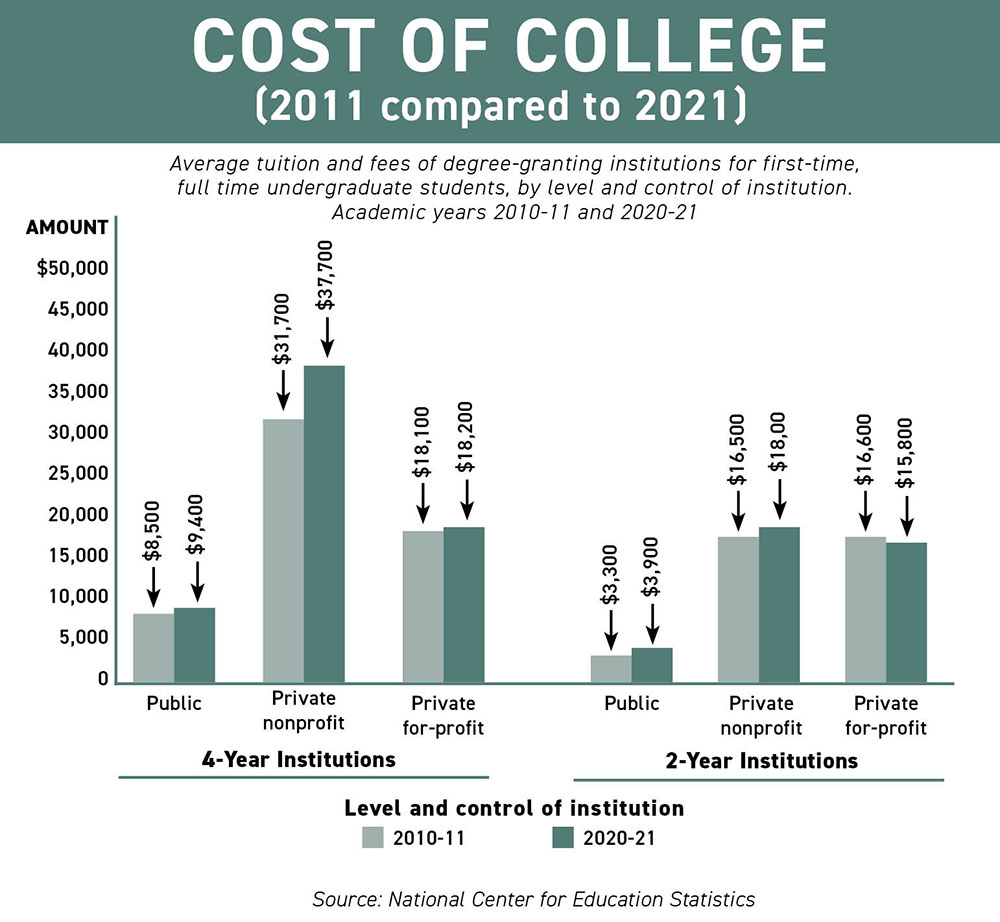

Average tuition and fees of degree-granting institutions for first-time, full time undergraduate students, by level and control of institution. Academic years 2010-11 and 2020-21.

Average tuition and fees of degree-granting institutions for first-time, full time undergraduate students, by level and control of institution. Academic years 2010-11 and 2020-21.

Noncash charitable deductions allow taxpayers to deduct the fair market value of donated items on their tax returns. These steps can help ensure your charitable deductions are adequately substantiated and accepted by the IRS.

Regardless of the value, you should have a receipt from the charity for any noncash donation. This document should include the charity’s name, the date and location of the contribution, and a reasonably detailed description of the donated property. Consider taking photos of donated items to document their condition.

If the value of your noncash donations is over $500 for the tax year, you must also include IRS Form 8283 with your tax return. For each item or group of similar items valued over $500, you must provide additional details including when you acquired the item and its original cost.

If you’re donating an item or a group of similar items worth more than $5,000, you’ll generally need a qualified appraisal of the item’s fair market value, and you must also complete Section B of Form 8283. There are exceptions for publicly traded securities, vehicles, and intellectual property.

What’s the difference between high-yield savings and money market accounts?

High-yield savings and money market accounts offer higher interest rates compared to traditional savings accounts.

A high-yield savings account is best for funds you don’t need to access frequently. There might be limits on the number of transactions allowed per month. You can find this account at banks.

Money market accounts often come with check-writing privileges and debit cards, offering more liquidity. However, they may require higher minimum balances to avoid fees and some money market investments are not FDIC insured.

These accounts are a good place to park cash or an emergency fund. Place long-term investments in vehicles that generally offer higher rates of return. Wherever you put your money, check the financial health of the institution.

Creating a Paid Time Off (PTO) policy is essential to a company’s benefits package. As an employer, you have the flexibility to design a policy that suits your business and meets the needs of your employees.

Ensure your policy adheres to applicable laws. Some states mandate specific types of paid leave, such as sick leave.

Decide the types of leave to include, such as vacation, personal days, and sick leave. Some companies opt for a “bank” system where all kinds of leave are lumped together, giving employees more flexibility.

Your policy should define how PTO is accrued. Is it based on hours worked or a set amount per year? Will unused PTO roll over to the next year? You must also outline how PTO requests should be made and approved, ensuring fairness and transparency.

Finally, communicate the policy to your employees. A well-structured PTO policy can enhance employee satisfaction, productivity, and retention. Review and adjust the policy periodically to keep it relevant and effective.

While preparing to sell your business you’ll need to create these key documents for any potential buyer.

These include income statements, balance sheets, and cash flow statements for the past three to five years. Additionally, you’ll need tax returns and bank statements.

The business plan provides an overview of the business, its strategies, and its market position.

This document details all physical assets including equipment, inventory, real estate, and intangible assets such as patents, copyrights, and trademarks. Include purchase date, cost, and current value.

Copies of all current leases for premises, equipment, and vehicles and contracts with suppliers, customers, and employees should be compiled.

This includes the articles of incorporation for corporations or articles of organization for LLCs, partnership agreements, and any licenses and permits required to operate the business.

Paula received a voicemail from an IRS employee asking for a call back on a toll-free number. She is current on her tax filing requirements and doesn’t owe any back taxes. So, she’s confused about why the IRS would contact her.

Paula is justified in being concerned. The IRS does not initiate contact with taxpayers by phone, email, text messages, or social media channels. Official IRS correspondence is sent through the US Postal Service. The letter provides detailed information regarding tax issues such as notices about discrepancies, bills for unpaid taxes, or requests for additional information.

Sometimes, the IRS may call taxpayers, but this is not common and usually follows an initial letter. During these calls, representatives never demand immediate payment or ask for credit card information over the phone.

Paula should call the IRS directly at 1-800-829-1040, not on the number left in the voicemail.

Client Profile is based on a hypothetical situation. The solutions discussed may or may not be appropriate for you.

The Free Application for Federal Student Aid (FAFSA) was revised to streamline the application process and alter eligibility formulas.

The changes took effect in July for the 2024-25 academic year and include a shift from the Expected Family Contribution to the new Student Aid Index (SAI) and a reduction in the number of application questions from 100 to roughly 40.

Some families could pay more tuition, particularly households earning under $70,000 with multiple children in college, as the sibling discount is removed under the new aid calculation formula.

Financial aid eligibility will change based on the family’s financial circumstances, where they attend college, and how many siblings are also in college.

The SAI will also influence students’ Pell Grant eligibility and the amount of additional institutional aid that schools can provide. Grants do not have to be repaid, unlike loans.

And for divorced families, the parent who needs to complete the FAFSA changes from the custodial parent to the one who provides the most financial support.

Don’t wait until December to review your Form W4. By then, it’s too late to make changes for 2023.

Compare your 2022 tax return with your current financial situation, including changes in income, marital status, or the addition of dependents. These factors can significantly impact the amount you should withhold.

Next, use the IRS Tax Withholding Estimator https://www.irs.gov/individuals/tax-withholding-estimator to calculate the right amount to withhold. This tool considers your income, dependents, filing status, and estimated deductions and credits.

After using the estimator, if you find that you’re not withholding enough, you can adjust your W-4. Fill out a new form and submit it to your employer. You can do this annually.

Selling small business stock can have significant tax implications, depending on several factors, such as the holding period, the nature of the business, and the type of stock sold.

The tax rate for selling small business stock depends on whether it’s a long-term or short-term capital gain. If you’ve held the stock for more than a year before selling, any gain will be taxed at the long-term capital gains rate, which is generally lower than the ordinary income tax rate. If held for a year or less, the gain is considered short-term and will be taxed at your ordinary income tax rate.

In certain situations, losses from selling small business stock can be used to offset other capital gains. You can offset up to $3,000 of other income if your losses exceed your gains. Any remaining losses can be carried forward to future years.

Section 1202 of the Internal Revenue Code provides a potential exclusion for gains from certain small business stock. If the stock is a Qualified Small Business Stock (QSBS) you might be able to exclude up to 100% of your capital gains from federal tax, subject to certain limitations. However, this rule only applies if you’ve held the stock for at least five years.

Another tax implication is the Net Investment Income Tax (NIIT). If your modified adjusted gross income exceeds a certain threshold, you may be subject to an additional 3.8% tax on any net gain from the disposition of your stock.

If the business is sold instead of just some of the stock, the transaction could have different tax implications, depending on whether it’s structured as an asset sale or a stock sale. Tax consequences can be complex and vary significantly.

Speak with your tax professional when selling small business stock.

How Small Business Stock Sales Are Taxed – selling small business stock can have significant tax implications.

Revisit Your Form W4 – don’t wait until December to review your Form W4.

New FAFSA Rules – the form was revised to streamline the application process and alter eligibility formulas.

Documents Required for a Business Sale – while preparing to sell your business you’ll need to create these key documents for any potential buyer.

Creating a PTO Policy – creating a paid time off policy is essential to a company’s benefits package.

August 2023 Question and Answer

Substantiating Noncash Charitable Deductions – steps to help ensure your charitable deductions are adequately substantiated and accepted by the IRS.

Cost of College – compare the average tuition and fees.