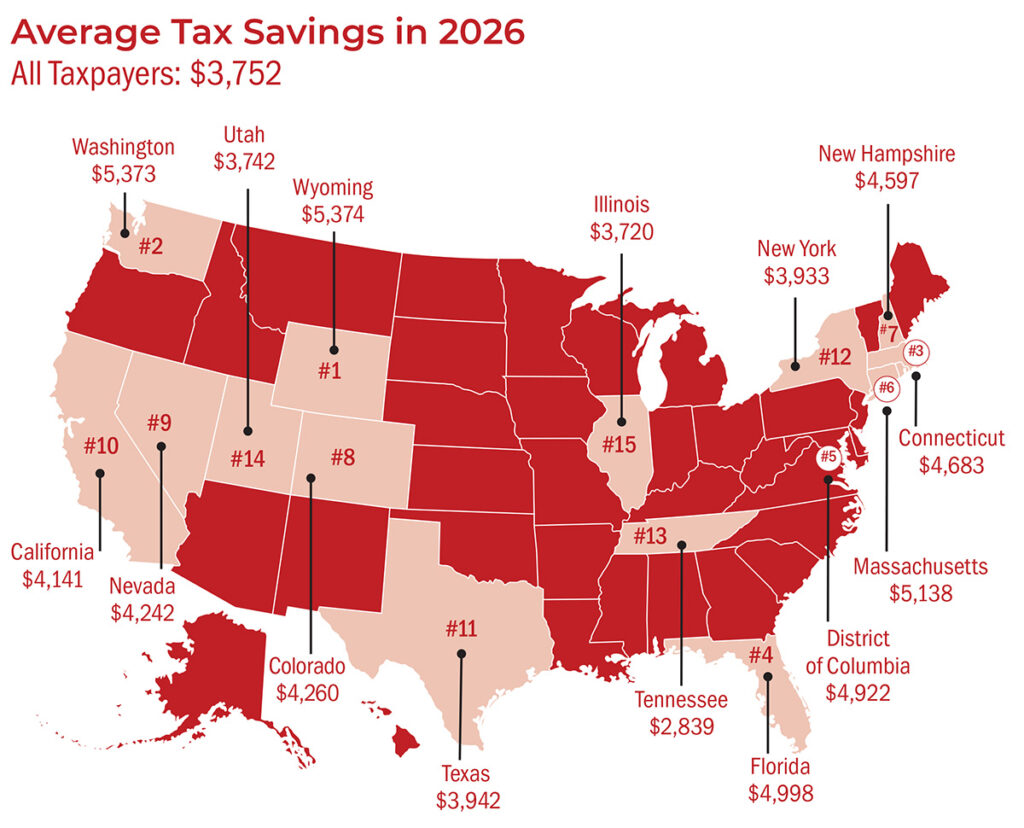

In a recent report, the Tax Foundation estimated the average change in taxes paid relative to prior law across each state and county from 2026 through 2035. Here are the results from the top 15 states:

Wyoming #1: $5,374

Washington #2: $5,373

Massachusetts #3: $5,138

Florida #4: $4,998

District of Columbia #5: $4,922

Connecticut #6: $4,683

New Hampshire #7: $4,597

Colorado #8: $4,260

Nevada #9: $4,242

California #10: $4,141

Texas #11: $3,942

New York #12: $3,933

Tennessee #13: $2,839

Utah #14: $3,742

Illinois #15: $3,752