Initially designed to ensure that high income earners who benefit from various deductions and credits still pay a minimum level of tax, the Alternative Minimum Tax (AMT) is imposed at a flat rate tax of 26% or 28%. The 28% applies to taxpayers filing jointly with $244,500 or more AMT income (AMTI) and $122,500 or more for other taxpayers. You’ll be subject to AMT if your tax calculated under the AMT rules is higher than your tax calculated under regular income tax rules.

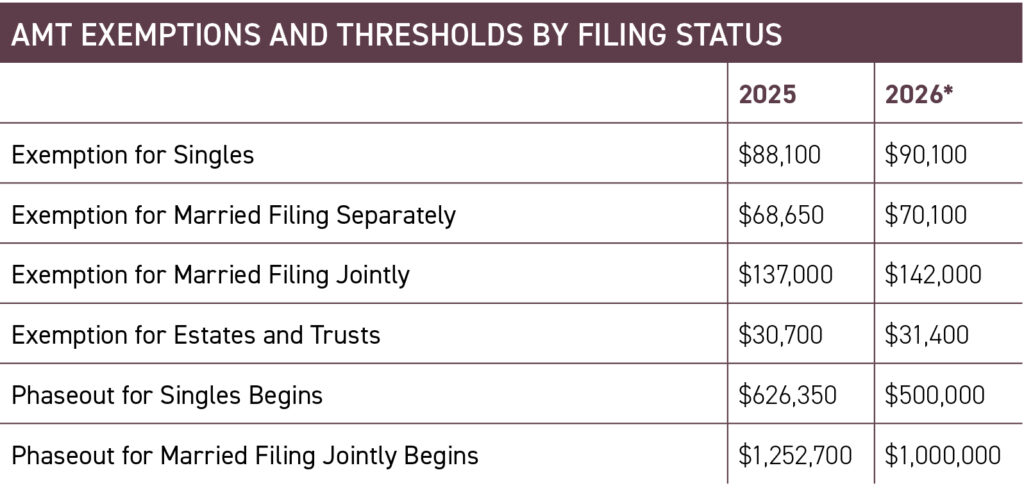

Before the Tax Cuts and Jobs Act (TCJA), AMT had increasingly affected a broader range of taxpayers due to its different rules and exemption structure. TCJA reduced AMT exposure, but those relief measures shift under the One Big Beautiful Bill Act (OBBBA) starting in 2026. As you see in the table below, for 2025, the phaseout of the exemption that single taxpayers may claim before AMT is imposed at $626,350 in AMTI. For married couples filing jointly, the phase begins at $1,252,700 AMTI.

Starting in 2026, however, OBBBA resets the exemption phase-out thresholds to the TCJA’s $500,000 and $1 million AMTI, with annual inflation adjustments for 2026 and beyond. So, for 2026, these phaseout thresholds will be lower than in 2025. More bad news: OBBBA also increases the exemption phase-out percentage from 25% to 50%. As a result, more high-income individuals may be hit with the AMT starting in 2026.

The AMT is complicated. Contact your tax professional to determine your status under the OBBBA changes.

*IRS Rev. Proc. 2025-32