Unfortunately, some parents believe that if they died prematurely guardians for their child(ren) would automatically be the Godparents. This may be their wishes, but unless they properly draft legal documents, the court will decide what happens to the children—and your assets.

SET UP A TRUST

While you can name a guardian in your will, you still need to set up financial support for young beneficiaries who cannot receive assets until they are older. That’s why parents often place assets in a trust. You can name the child’s guardian or a trustee to manage the assets and you can specify when and how your child, or guardian, receives money. Trusts are also private, unlike wills that usually have to go through probate and become public record.

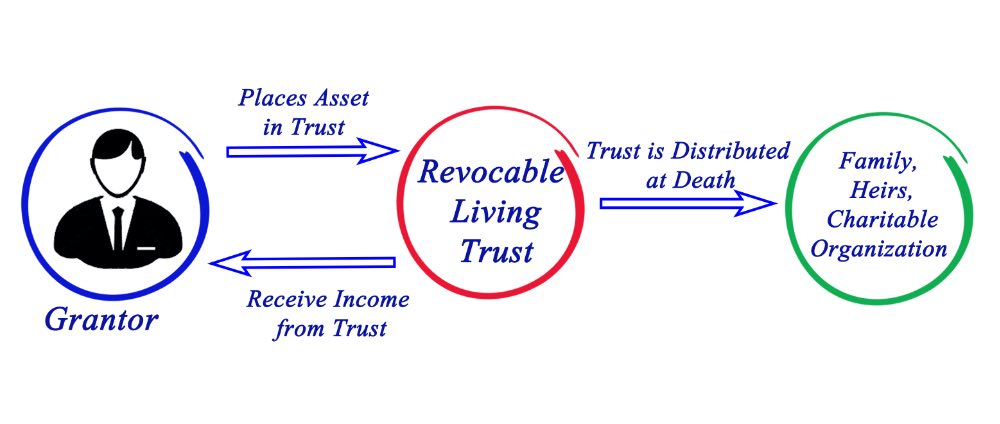

A popular choice is a revocable living trust. Benefits of a revocable living trust are that you can change it as often as you like because it remains your personal property until you die.

Planning for a disabled child is a bit more complicated. A good option in this situation is a special needs trust, which can help ensure the care and oversight needed indefinitely.

BENEFICIARIES

Consider life insurance to replace parental income and name the revocable living trust as the beneficiary. Also, make the trust beneficiary of all your retirement accounts. This will ensure that the proceeds flow directly to the living trust and can be used to provide for your child’s care.